Refueling Infrastructure Tax Credit

What’s on This Page?

The Inflation Reduction Act of 2022 (IRA) extended and amended the 30C Alternative Fuel Vehicle Refueling Property Credit (30C credit), which provides an income tax credit for qualified alternative fuel vehicle refueling property, including certain property for the recharging of an electric vehicle, placed in service in eligible census tracts, which are low-income community census tracts or non-urban census tracts as defined in IRS Notice 2024-20 (discussed further below). Individuals, businesses, and certain state, local, and other tax-exempt entities are eligible to claim the 30C credit. The information this mapping tool provides is intended to reflect currently available data for the two types of eligible census tracts relevant to the 30C credit. The 30C credit provides:

- Consumers who purchase and install qualified alternative fuel vehicle refueling property for their principal residence, including electric vehicle charging equipment, between December 31, 2022, and January 1, 2033, may receive a tax credit for each item of property that is generally the lesser of 30% of the property’s cost or $1,000.

-

For businesses as well as applicable entities, including state, local, tribal and other qualifying tax-exempt organizations, the credit for each item of property is generally the lesser of 6% (or 30% if certain prevailing wage and apprenticeship requirements are met) of the property’s cost or $100,000. The credit is available for property placed in service between December 31, 2022, and January 1, 2033.

The IRA also expanded the definition of “qualified alternative fuel vehicle refueling property” to include charging stations for 2- and 3-wheeled vehicles (for use on public roads) and clarified that bidirectional charging equipment qualifies.

Eligible Census Tracts

The mapping tool on this page reflects currently available data on the two types of eligible census tracts. The most recent map update took place on April 15, 2024 per the Internal Revenue Service press release.

Eligible census tracts fall into two categories and eligible property can be in either type of tract (or both, if the tract falls under both categories) to qualify:

- Low-income community census tracts: Population census tracts as described in Internal Revenue Code section 45D(e), i.e., the “low-income community” definition of the New Markets Tax Credit (NMTC).

- Non-urban census tracts: Population census tracts defined as “not an urban area” (or “non-urban area”) according to Treasury/IRS guidance.

These categories of population census tracts are defined IRS Notice 2024-20. The mapping tool on this page reflects currently available data on the two types of eligible census tracts.

This mapping tool is intended to reflect all eligible locations for the 30C credit but is not formal IRS guidance. Thus, this mapping tool may not be relied upon by taxpayers to substantiate a tax return position and will not be used by the IRS for examination purposes. The mapping tool does not reflect the application of the law to a specific taxpayer’s situation, and the applicable Internal Revenue Code provisions ultimately control.

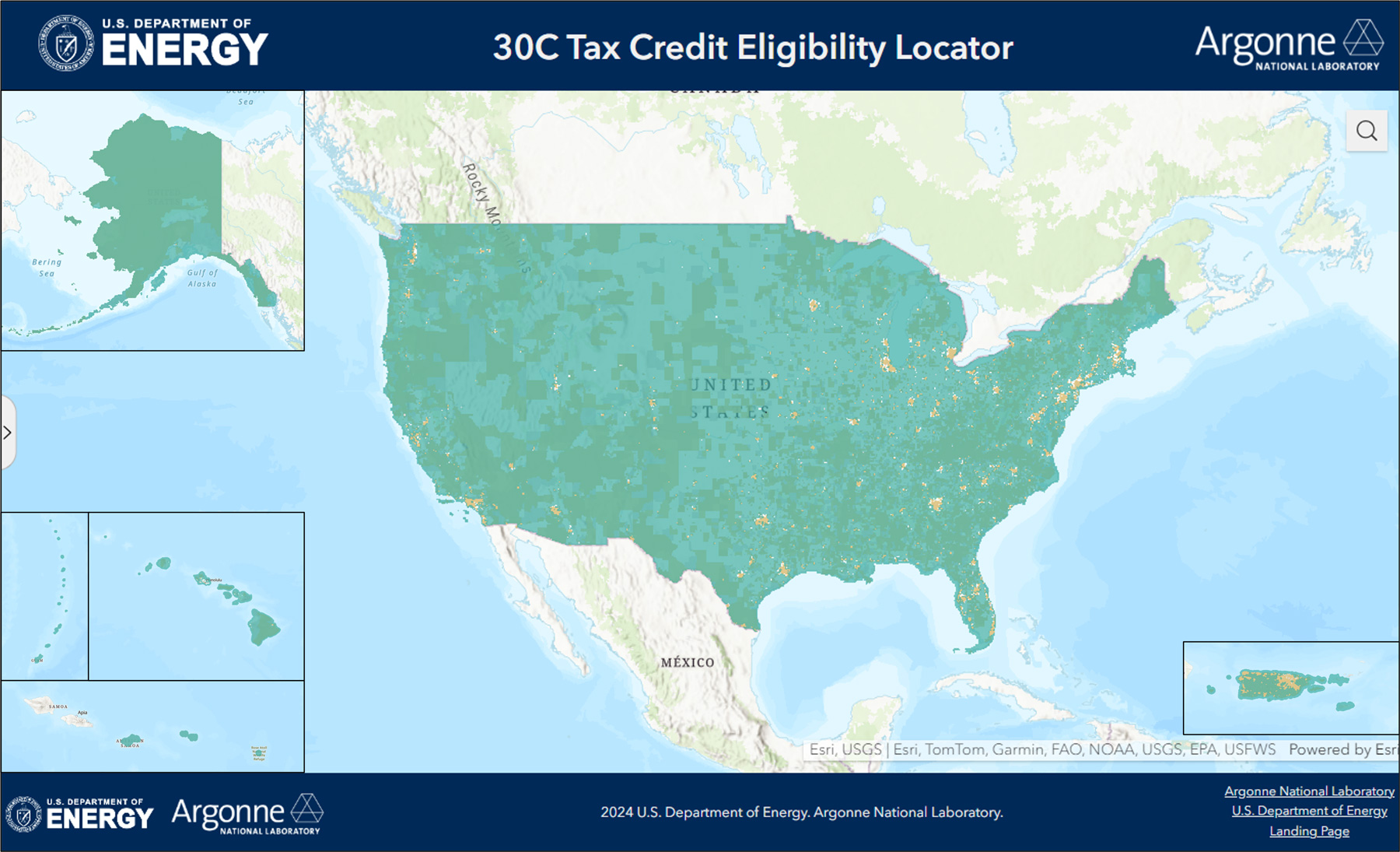

30C Tax Credit Eligibility Locator Mapping Tool

First, the map shows “low-income community census tracts” for two different determinations of such tracts, based on delineations of census tract boundaries conducted at two different times. These two determinations and census tract boundary delineations are:

- “2011-2015 NMTC tracts,” referring to the low-income community population census tract determinations by the Community Development Financial Institutions Fund (CDFI Fund) for the NMTC program based on the 2011-2015 American Community Survey 5-year estimates and the 2015 delineation of census tract boundaries. This determination can be used for qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022, and before Jan. 1, 2025.

- “2016-2020 NMTC tracts,” referring to the low-income community population census tract determinations by the CDFI Fund for the NMTC program based on the 2016-2020 American Community Survey 5-year estimates and the 2020 delineation of census tract boundaries. This determination can be used for qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022; such tracts are anticipated to remain eligible locations for the 30C credit through 2029, after which the NMTC updated census tracts will provide the determination of low-income community census tracts.

Second, the map shows “2020 non-urban census tracts,” referring to Treasury/IRS determinations of Census tracts based on 2020 Census Bureau determinations of ‘urban areas’ and 2020 delineation of census tract boundaries. This determination can be used for qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022; such tracts are anticipated to remain eligible locations for the 30C credit until the Census Bureau’s determinations of 2030 urban areas are released.

For more information on how low-income community determinations are made and how census tract boundaries are delineated please refer to IRS Notice 2024-20.

Anticipated Eligible Low-Income and Non-Urban Census Tract Descriptors Based on Placed in Service Date, All Years of the Credit

For Refueling Property Placed In Service between January 1 through December 31 of the following year

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Low-Income Community Census Tracts | Use “2011-2015 NMTC tracts” or “2016-2020 NMTC tracts” | Use “2016-2020 NMTC tracts” | Use “2016-2020 NMTC tracts” or anticipated update (see Notes below) | Use anticipated update (see Notes below) | ||||||

| Non-Urban Census Tracts | Use “2020 non-urban census tracts” | Pending possible update (see Notes below) | ||||||||

Notes

Anticipated update for low-income community census tracts: Low-income community census tracts will be updated for purposes of the 30C credit upon future releases of NMTC census tract determinations by the CDFI Fund. It is anticipated that the CDFI Fund will release an updated set of NMTC tracts in approximately late 2028 (“updated NMTC census tracts”). The 2016-2020 NMTC tracts are anticipated to remain eligible locations for the 30C credit through 2029, after which the updated NMTC census tracts will provide the determination of low-income community census tracts. After the updated NMTC census tracts are released, it is anticipated that guidance will be released reflecting the updated set of low-income community census tracts.

Possible update for non-urban census tracts: Non-urban census tracts may be updated for purposes of the 30C credit if the Census Bureau releases determinations of urban areas based on the 2030 decennial census before 2033. However, the Census Bureau released the 2020 determinations of urban areas in 2023; therefore, it is anticipated that the 2030 determinations of urban areas will not be released until 2033. In the event that the Census Bureau releases determinations of the 2030 urban areas earlier than January 1, 2033, it is anticipated that guidance will be released reflecting the updated set of non-urban census tracts. Until that time, taxpayers should use the 2020 non-urban census tracts to determine eligibility for the 30C credit.

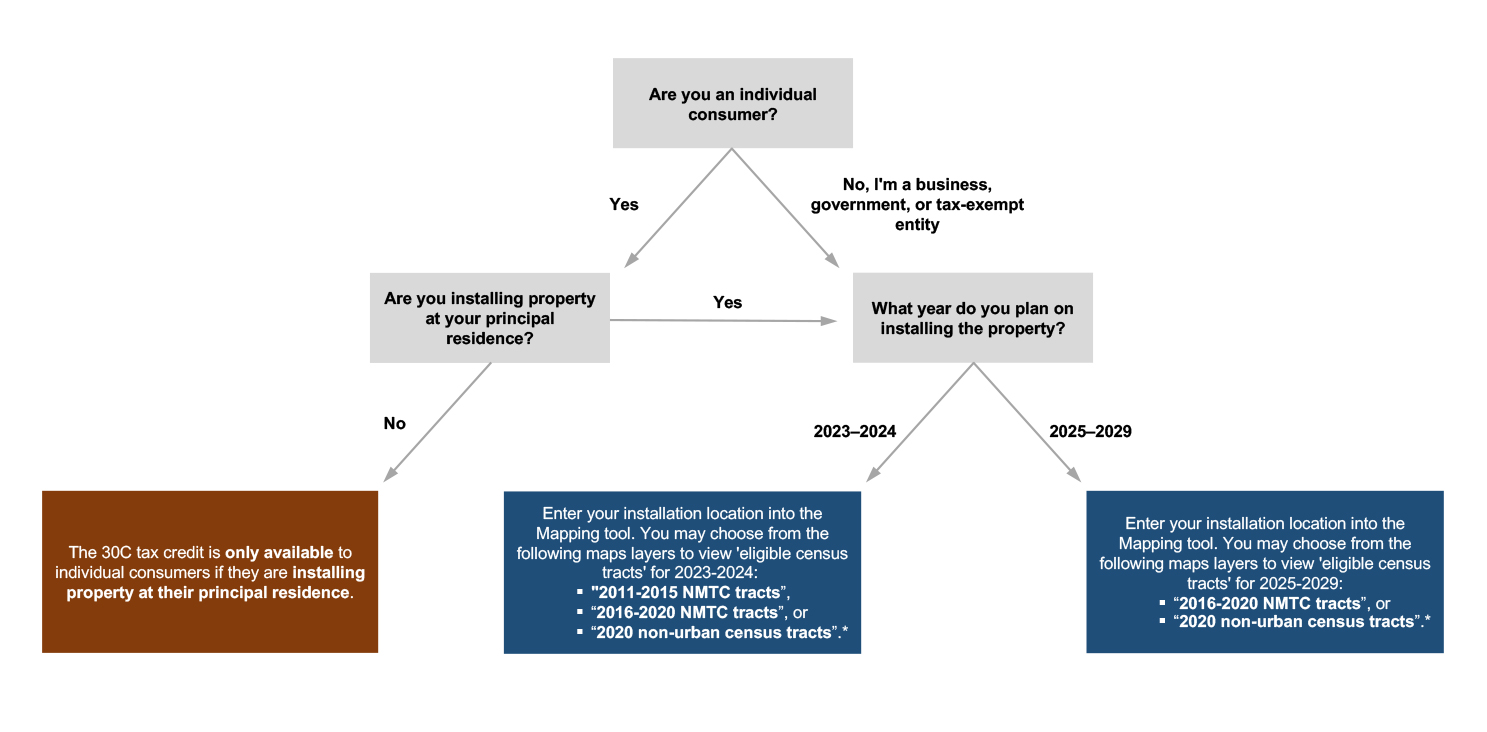

30C Location Eligibility Decision Tree For Properties Placed in Service Between December 31, 2022, and January 1, 2030, Using Currently Available Data

* This flow chart was developed to assist users in understanding which map layers correspond to the year of installation when operating the mapping tool. The mapping tool is not formal IRS guidance. Thus, this flow chart may not be relied upon by taxpayers to substantiate a tax return position and will not be used by the IRS for examination purposes. The flow chart does not reflect the application of the law to a specific taxpayer’s situation, and the applicable Internal Revenue Code provisions ultimately control. Additionally, individuals or entities looking to claim the credit may wish to consult with a tax professional, accountant, or attorney on questions regarding eligibility. This decision tree only shows options for properties placed in service between Dec. 31, 2022, and Jan. 1, 2030, using currently available data. This decision tree and the map will be updated upon release of new data and Treasury/IRS guidance.

.